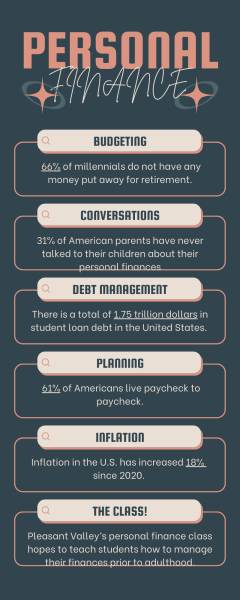

31% of American parents have never talked to their children about their personal finances. 66% of millennials do not have any money put away for retirement. 61% of Americans live paycheck to paycheck. There is a total of 1.75 trillion dollars in student loan debt in the United States. Inflation in the U.S. has increased 18% since 2020. Pleasant Valley’s personal finance class hopes to teach students how to manage their finances prior to adulthood.

If current economic trends continue, achievements like buying a house will become increasingly difficult for younger generations. To ensure a bright financial future, students must start building positive financial habits now.

However, the booming consumer culture in the U.S. tests the discipline of citizens to upkeep their financial goals.

Over half of Americans found social media troubling to their financial goals; surveyors claimed social media caused them to overspend their budget. Apps like Facebook promote consumption through extensions like Facebook Marketplace, allowing users to scroll and buy products with little hassle.

Influencers also impact spending habits. Targeted at Gen Z, influencers– such as Alix Earle– post “get ready with me” videos where they show the products they use and direct their followers to shop the products in their LTK. LTK is a website and app that connects users with reviewed products. The company pays commission to influencers who bring sales through their LTK links. These LTK links allow easy access for young adults to overspend to own their influencers’ favorite products.

Social media may have influenced a change in personal finances, but Pleasant Valley finance teacher Rita Brown noticed the increased accessibility to credit compared to when she grew up.

“Most of the wisdom on personal finance we get from seeing our parents and seeing how they model their own personal finance. But it’s a different world today, because our generation never had credit marketed to us, so between credit cards and buy now pay later and loans coming at you from every direction. Now, double that with doing business with people you don’t see…and it allows for more unethical practices, so those two combined puts you in a position where you need to be better informed. So, the responsibility is going to rely on you,” Brown said.

This current economy makes it difficult for many American families to reach financial freedom, so it is vital younger generations have financial goals and begin saving early.

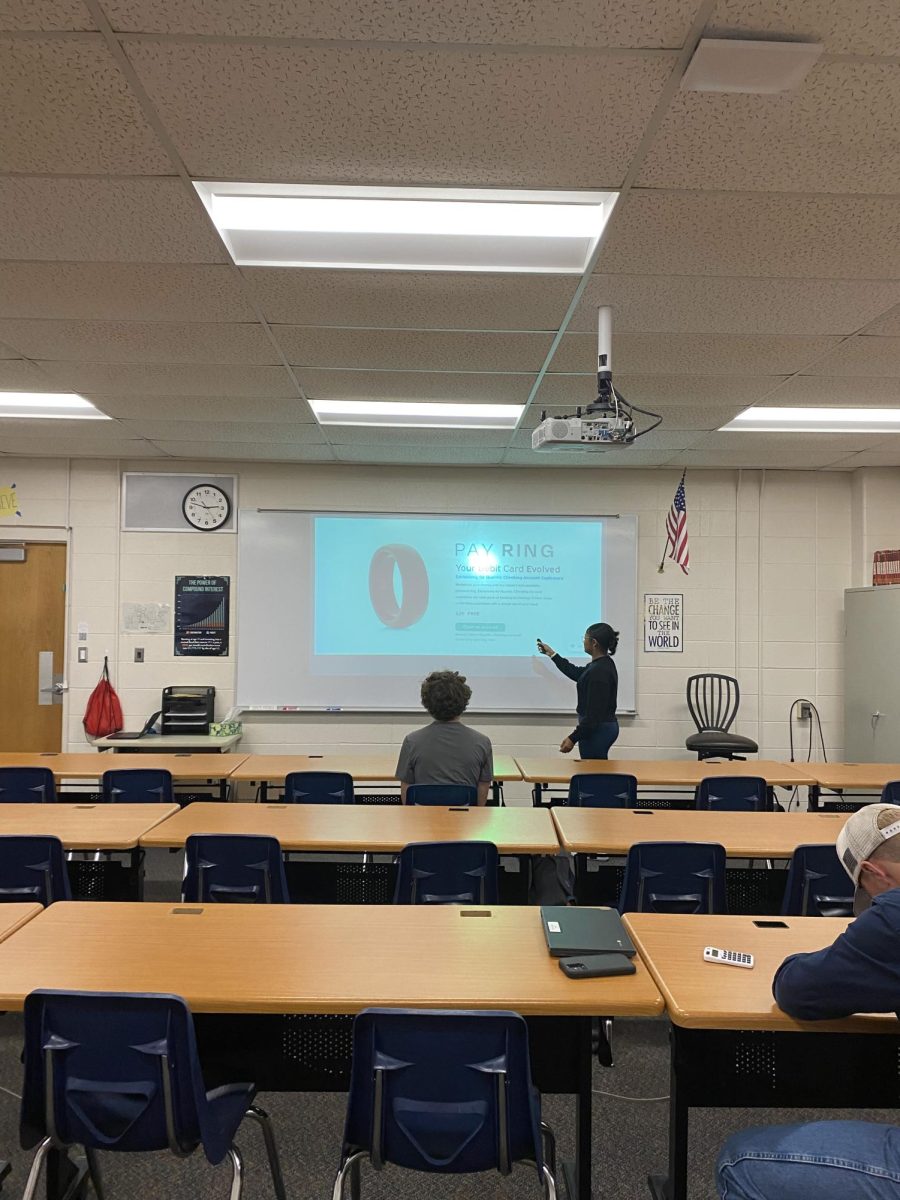

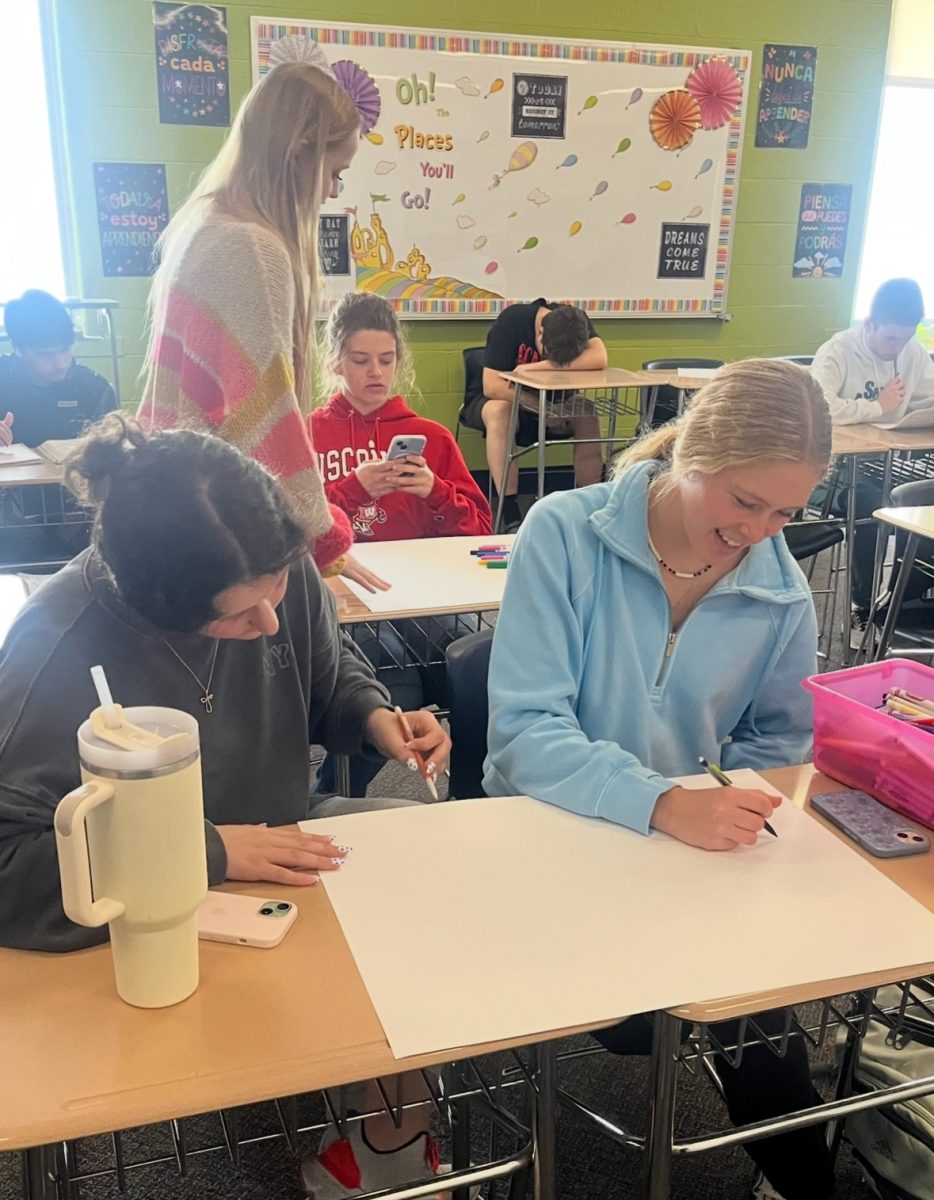

Thankfully, PV offers a personal finance course for junior and senior students. Despite being early in the school year, students like junior Abby Rogers already realized the importance of learning about personal finance and believed personal finance will be vital for teens’ future financial success: “I think learning about personal finance will be important for when economic issues come. Personal finance can teach us taxes and finance stuff that will impact us in the future, so we can be successful,” Rogers said.

Brown noted that many students enter her personal finance course hoping to learn how to get rich quick; however, Brown enjoyed seeing the perspective shift of students after learning about building wealth.

“A lot of students think this is a finance class, so they’re going to come in to learn how to invest their money and get rich quick. That’s one unit out of nine. The purpose of this [class] is to learn about credit scores, loan amortization schedules, maybe choosing a post high school path that doesn’t involve taking on a lot of debt, and insurance and how to research banks and credit cards.”

“So, it [the class] encompasses every aspect of personal finance, not getting rich quick. We use the slow method of building wealth. So, some students are disappointed when coming in but then realize the importance of everything else,” said Brown.”

Offering college credit and a teacher with decades of experience working as an accountant, Pleasant Valley’s personal finance course sets students up for a profitable future.