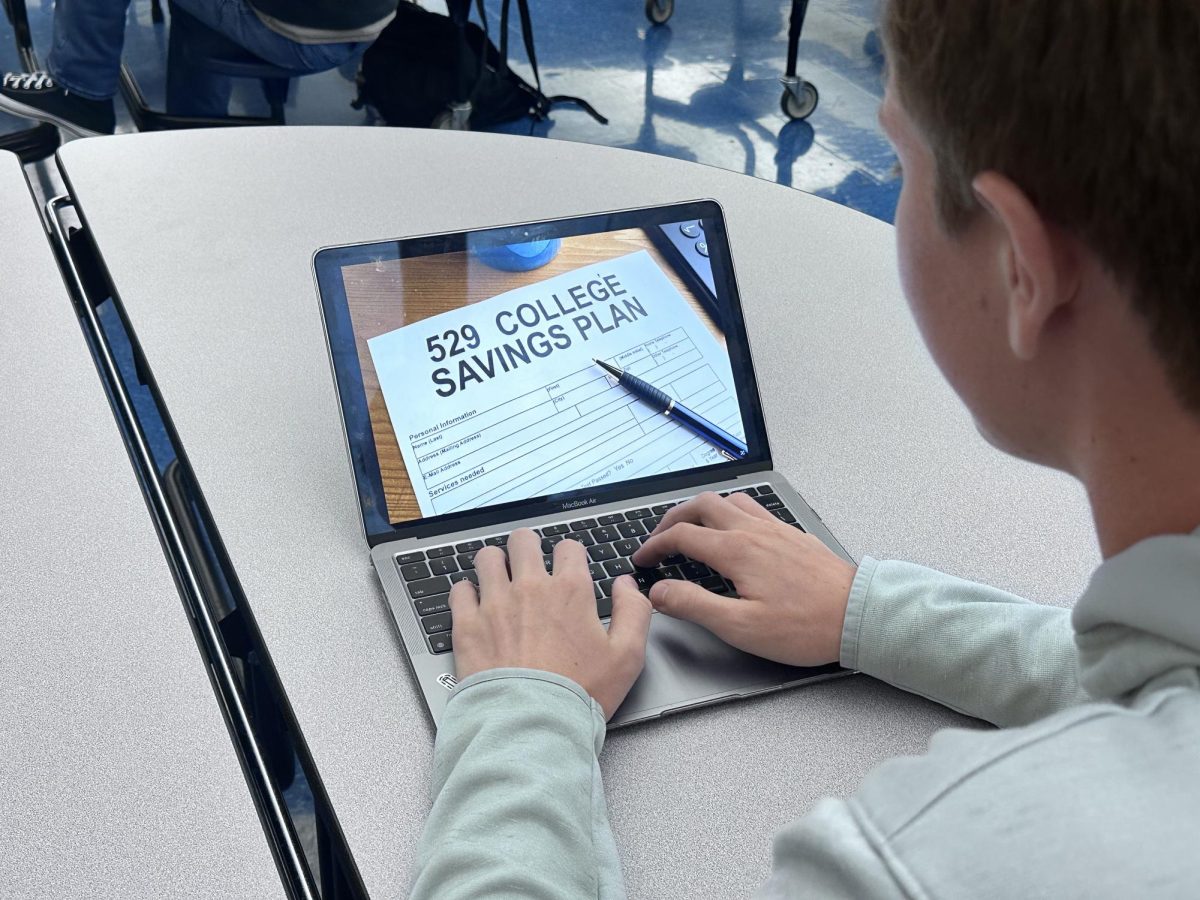

A 529 Plan is a state-certified investment portfolio that allows beneficiaries to invest money into a plan that allows people to access and utilize tax-free funds to pay for qualified education expenses. This allows students to pay and access higher sources of education through a more affordable route.

Business teacher and accountant Rita Brown utilized and firmly believes in the benefits 529 plans offer. “One of the tax advantages is that when you put savings funds into a 529 plan and Iowa invests the money for you, the income is tax free,” stated Brown.

A few of the qualified expenses included in the 529 plans are tuition and fees, books and supplies, health insurance, student loans, laptops and internet and software access.

Brown also emphasizes the convenience and the benefits 529 plans can provide. “You can put funds in one day and take it out a day later…If your state properly invests your money, it’s a surefire way to gain tax-free income,” Brown said.

Sophomore Jack Rippchen firmly believes 529 plans benefit students when venturing into college. He shared his insights: “529 plans allow students to minimize their stress towards paying for tuition and college expenses. Overall, it just helps students be financially more well off” said Rippchen.

The 529 plan not only benefits students with the possibility of gaining tax-free high-return investments, but can also allow for tax deductions within specific states.

529 plans’ benefits exceed college needs as well. As long as the apprenticeship program is certified with the U.S. Department of Labor, 529 funds can pay towards an apprenticeship program tax-free.

529 college funds allow students to access tax-advantaged and tax-free funds. This allows students to attain cheaper laptops, tuition fees, room and board costs and more. Investing in the future by making smart and efficient financial decisions is vital to minimizing future debt and problems. Starting a 529 permits students to access education funds while also benefiting from tax-free investments.

molly • Oct 22, 2023 at 12:55 pm

I think this article is really educational. I don’t think high school students are taught enough about financials and college loans